Mayor Cooper’s FY 21 Budget-What you need to know!

Last night Mayor Cooper presented highlights of the FY21 budget to the Council. While many cities and counties are feeling the impact of the COVID-19 virus, many can tap into their fund balance (i.e. rainy day funds) to see them through. Unfortunately, Metro has no fund balance. Below are highlights from the Mayor’s presentation on our current situation and the proposed path forward.

Highlights from the Mayor’s Budget

Issues

- Metro Finance was in a bad state prior to the start of this budget season. Fund balance at the end of FY20 is projected at an abysmal $12M (the average fund balance for the past 5 years have been (100M). See here for my blog on why and how we got here – https://zulfatsuara.com/the-current-state-of-metro-finances/

- This poor financial situation is now compounded by the tornado and COVID-19

- Loss of revenue as a result of COVID-19 is estimated at $192M for the last quarter of FY20 and $280M for FY21

Property Tax Increase

As indicated above, the projected sales tax revenue loss as a result of COVID for FY 21 is $280M. The administration was able to identify new revenues totaling $64M for a net loss of $216M. In addition, the goal is to replenish cash by increasing the cash balance at the end of FY 21 to $100M plus an additional $16M in FY21 operating need. This adds up a total need of $332M to balance FY 21 budget. In order to meet this goal, the administration is proposing a $1.00 increase in property tax rate.

How much will I pay in taxes based on the new rate?

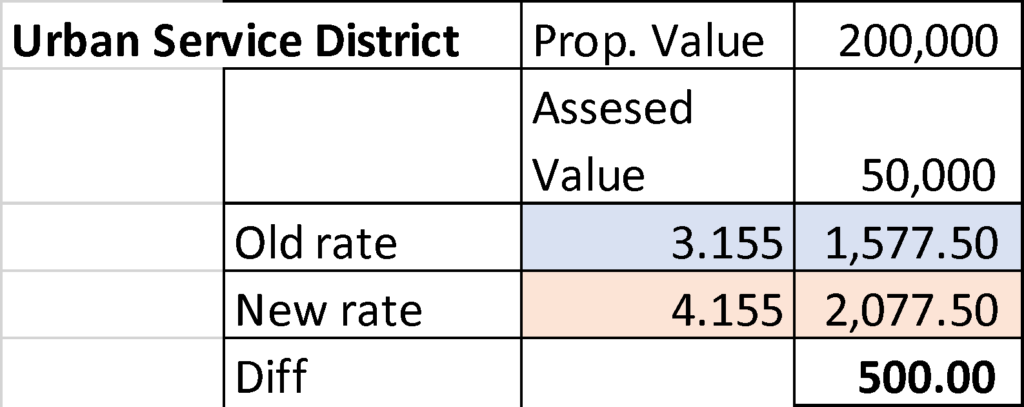

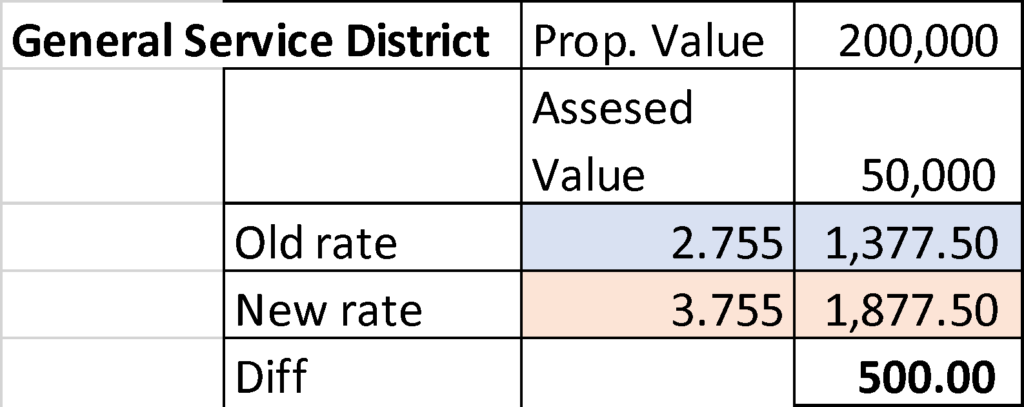

If you live in the Urban Services District – Your current property tax rate is 3.155. Based on the proposal, your new rate will be $4.155. For the General Service District residents, the current property tax rate is 2.755 while the proposed rate is 3.755. Assuming your property value is $200,000, your calculation will be as follows:

*Assessed value is your property value divided by 4.

Easy DIY calculation: To figure out how much more, you will be paying, divide your assessed value by 100. If your assessed value is $25,000, your increase will be $250 ($25,000/100).

Other Proposed Solutions

In addition to the $1 increase in property tax, the Mayor’s budget also include the following additional solutions:

- Reduce Capital Spending- thereby reducing and extending debt payments

- No longevity pay

- No layoffs

- Cut departmental budget by $12M

- Cut discretionary funding (Not for profit funding) by 50%

What about federal assistance?

Unfortunately, the current federal assistance (CARES ACT) has restrictions on its spending. It is limited to COVID-19 related expenses. It can not be used to replace loss of revenues or to replace items already in our current budget.

Councilmember Porterfield filed a resolution urging our US Senators and Congressmen to work on releasing the restrictions on the funds. The National League of Cities is also working on this at the national level with the hope that making funds unrestricted will go a long way in helping cities and municipalities.

I highly recommend calling Senators Alexander and Blackburn and Congressman Cooper to urge them to do so. I believe this will help tremendously. Here is how you can contact them:

Alexander – 202-224-4944 (DC); 615-736-5129

Blackburn – 202-224-3344 (DC); 629-800-6600

Cooper – 202-225-4311 (DC); 615-736-5295

What’s next?

The Metro Council will receive the full budget in a day or two. Needless to say that we have our work cut out for us. We have until June 30 to review and approve the budget or have a substitute. During that time, the budget and finance committee will be conducting department hearings and work sessions. There will also be a public hearing. See here for the full budget committee calendar. The Finance Department’s website also has good resources for constituents. The Citizen’s Guide to the Metro Budget can be accessed here.

While I believe in a marginal increase in property taxes is needed, I do not believe it has to be this high. Thus, we must look at all possible alternatives that will enable us to reduce this burden on Nashville residents during these trying times. Such alternatives include but are not limited to:

- Working with federal legislators to release restrictions on federal funding

- Reviewing the estimated revenue loss for the fourth quarter prior to final vote for any possible savings

- Considering metro’s ability to participate in the federal municipal liquidity facility- a program that will now allow counties and cities to be eligible for selling their short-term debt directly to the Fed and the U.S. Treasury.

Conclusion

No one could have predicted that this would be our new reality. Please know that the situation is fluid and there are other factors that could impact the final budget. We will be considering all of our options and possibilities when debating the budget.

I have put together a team of 5 top finance experts in our community to assist me in looking at the budget in detail and offer advice. I will also be hosting a Facebook live event every Saturday from 3pm-4pm to take your comments and answer your questions. You can join via my Facebook page here:

I ran on a platform of seeking your input in the budget process, I therefore welcome your emails and your suggestions. While I cannot guarantee what the result will be, I can promise to listen and to leave no stone unturned.

We are a resilient city and together, we will come out better on the other side. I pray for guidance and discernment for my colleagues and I, that we may make the best decision for all Nashvillians.

AT-Large Council Member Zulfat Suara please know the budget with a 32% increase will tax homeowners out of their homes. Those who have worked hard to pay off their homes can not afford an increase like this when the receive a social security COA of $18 a month. Vote down this budget which places everything on homeowners who can not shoulder this burden!

Community Advocate D-23 Lou Wilbanks

Thank you, Lou!

Thank you! Difficult times call for difficult decisions.

I look forward to seeing the details. Maybe we could even get more performance standards and benchmarks for services provided.

Let me know if I can help.

Knowing you are working in this and have a voice in our final decision gives me less anxiety moving forward. Thank you for your leadership and knowledge and taking the time to “break-down” this information for the people of DAVIDSON County.

To my council members, …the city is in part in this financial situation do to your free handed spending in the past 7 years, and allowing the past 3 mayor’s to spend with no accountability to balance the cities budget, ” you” have been irresponsible knowing what the financial situation has been…so my hope is that ” you” have learned the lesson of responsible budgeting…NO more free tax packages to incoming companies…enough is enough…I voted in John Cooper for the sole purpose that he would balance our budget and stop the fee hand spending…my point is you can raise taxes 50 percent, but of you do not charge the way you spend ,it will never be enough! The greatest shame these past years is the lack of support to our schools and local police Force, shame on you…so yes I agree we all must now give a little more to stabilize our situation….but 32 percent is a little excessive….do your part and budget wisely,stop overspending, and stop with giving our money away to sports deals and other frivelous deals….thank you Mrs.Baggett

This is ridiculous! Force people not to work and then demand more taxes?!

How much of the money going to the soccer stadium would cover this new tax?

While I understand Mayor Cooper inherited a financial mess, there have to be more cost-cutting measures and not just tax home-owners as the “only” solution. A balanced-budget and funding for programs are all great, but we didn’t get into this mess in 1 year.

I’m not sure why it is necessary to dig out of it in 1 year, at the cost of the people who, for the most part, did not cause the situation in the first place. You mentioned a few other items, but this tax increase finally has me thinking of moving out of this county. I’ve paid for enough things in this town that I see little benefit of. Antioch has been neglected for the better part of 15 or more years. An now, I am to pay more for, what is basically, saving downtown. Vote NO. There has to be a better way than killing the goose to get one last golden egg.

Exactly!

Honorable John Cooper;

As an 18 year resident of Metro Nashville and registered voter, I formally insist the following budget adjustments are implemented before any tax or fee increases are considered. I believe you and the City Council will find that these measures will alleviate the budget shortfall caused by your shutdown of the city and make any tax hike unnecessary. I am sure you will agree that any shared sacrifice should start with those elected, appointed and hired to serve the residents of Nashville.

1. The immediate permanent 20% reduction in the salaries of the mayor, City Council and all appointees.

2. The immediate 10-20% reduction in the salaries of department heads, managers and supervisors under the above city leaders with the exception of police, firefighters and all first-responders.

3. The immediate 5-10% reduction in the wages or salaries of all city workers with the exception of police, firefighters and all first-responders and their support staffs.

4. The immediate freeze in any unnecessary overtime by city workers with the exception of police, firefighters and all first-responders and their support staffs.

5. The immediate freeze on all hiring with the exception of police, firefighters and all first-responders and their support staffs.

6. The immediate closing and layoff of all those in the Nashville tourist department.

7. The immediate suspension of all travel by city leaders and workers.

8. The immediate suspension of all expenses and reimbursements for ceremonial events of any kind such as ribbon cutting, personal appearances and photo ops.

9. The immediate cancellation of any new vehicles for city use with the exception of those for police, firefighters and all first-responders and their support staffs.

10. The immediate suspension of all projects that do not directly provide for the current safety of city residents and their reevaluation for possible cancellation.

11. The immediate 5-10% cut in the budgets of all departments with the exception of police, firefighters and all first-responders and their support staffs.

12. The immediate freeze on any increase of the benefits for city leaders or workers with the exception of police, firefighters and all first-responders and their support staffs.

13. The immediate freeze on any second or third party contacts and the reassessment for possible termination and/or renegotiation for lower terms.

Many companies in the Metro Nashville and surrounding communities are taking the above steps to remain in business. City leaders must lead from the front and by example by also implementing these policies which will keep Nashville residents safe and financially able to meet their daily expenses without the burden of additional taxation. The federal government relief checks should go to current bills and obligations of residents not to increased city taxes.

It should be noted that most families in Metro Nashville have experienced some form of job loss, pay decrease or unexpected expenses directly attributed to the shutdown order you issued and they continue to suffer loss the longer you maintain it. Many small businesses have been financially damaged if not permanently ruined. The proposed tax increase will take on average 25% of the $2400 many household hope to receive from the federal government.

Finally, as city leaders in a gesture of your belief in the necessity of the edict, you, the City Council and all city leaders should make formal statements attesting to your complete adherence to and compliance with the stay-at-home order. It is important that residents know their city leaders have practiced these safety measures without exception.

As mayor and City Council members, you accepted election to your offices with the promise to put the interests of the city residents first and foremost. We now wait to see if those promises were just words or if you are willing to make the tough choices.

Sincerely,

Thank you for taking the time to comment and for offering solutions. I do appreciate it. I want you to know that items 1-3 on your list have been proposed by some members of council. I support the suggestions to. Having our high wage earners to take a reduction. Unfortunately, metro charter does not allow us to do that. We cannot just reduce the salary of a class by charter. Also please note that the mayor’s plan as it is have removed longevity pay for all departments. I addition, there is currently a hiring freeze and a travel freeze. Thanks again for your comments. I will keep them in mind as our deliberations continues and we work towards a budget that works for all Nashville

It would be foolhardy to rely on the federal government to reduce restrictions on CARES funds, wishful thinking that estimated fourth quarter revenue losses will be less than believed, and a disregard of fiduciary responsibility to refinance short term debt for a few years to stave off a much needed property tax increase in Davidson County.

As a resident we’ve paid an unsustainably low property tax rates for years! As a constituent I expect the police to answer when I call and the fire department to service my home. Those services are paid for with property tax dollars. Try selling your home in a bankrupt city that has limited its public safety services!

Mathematically the increase is not as bad as it should be! Take a look at your property tax bill; I did! You know how much that 32% is going to cost me (well my mortgage company up front) …about 324.00 for the year. Yep… 27.00 a month.